GST Reform 2025: Government Slashes GST Rate

#gst #gstslashes2025

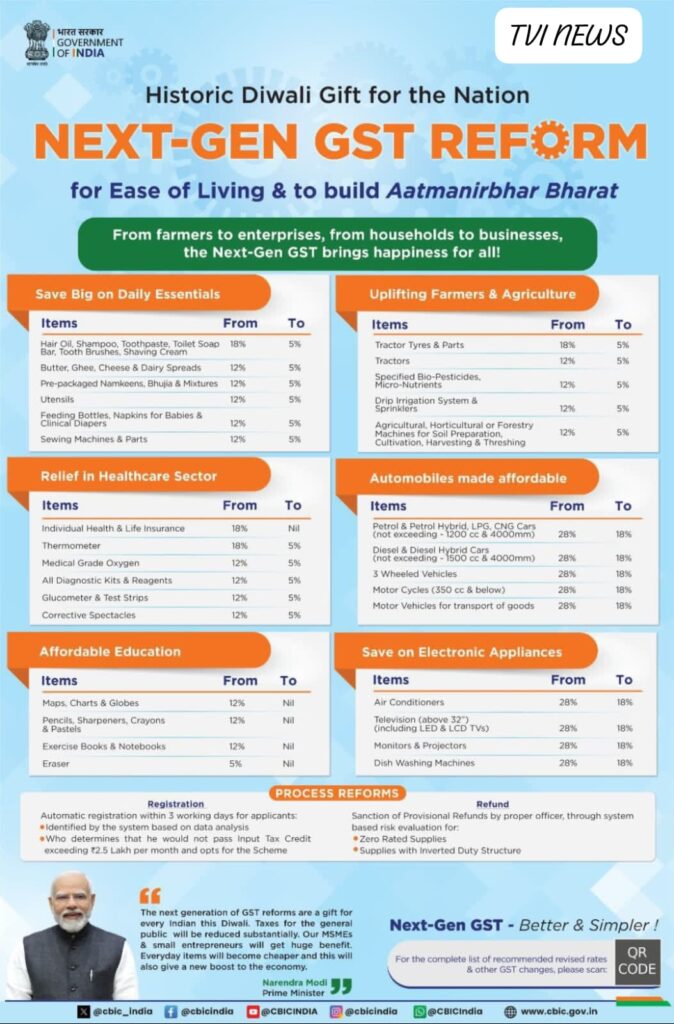

A piece of good news has arrived for the people of India. The government has reduced GST rates. Those who were troubled by inflation in India will now get some relief because with the decrease in GST rates, inflation will also come down. Daily use goods now have reduced tax. For the common man, this is very big and happy news.

Rate Slashes from Four Slabs to Two

The GST Council has given India a Diwali gift in advance this time. Earlier, India had 4 GST slabs – 5%, 12%, 18%, and 28%. But now they have been reduced to only 2 slabs – 5% and 18%. This rule will be implemented from 22 September 2025.

This time, the government has taken the decision very thoughtfully. Less tax has been applied on essential goods, while higher tax has been placed on harmful and luxury items. For example, cars, tobacco, and such products will now come under the 40% tax slab.

Goods and Electronics Become Cheaper

Our daily use food items like packaged food, milk products, medicines, toothpaste, etc., have now come under the 5% tax slab. Earlier, these were taxed at 18%, but now it is only 5%.

Some goods have even become tax free, such as paneer, bread, noodles, chocolate, cooking oil, sugar, etc. These items will now have 0% GST, which means no tax at all.

Along with this, ACs, TVs, washing machines, and many other electronic items have also seen a reduction in tax. With the festive season just around the corner, the government has given people a big reason to celebrate by reducing GST on such items.

Profits and Losses in GST Slashes

For Consumers: With cheaper goods, people will now be able to save money. Earlier, due to high inflation, buying daily items was difficult and savings were nearly impossible. But now, with lower GST, people can buy their needs and still manage to save.

For the Middle Class: This step is a huge relief. As tax on daily food items is reduced, middle-class families will finally breathe a sigh of relief.

For Luxury Buyers: On the other hand, those who buy luxury goods will face a little loss because GST on luxury items has increased from 12% to 18%.

Overall Impact

The GST Council’s decision has made the middle class and lower class very happy. The middle class can now save money, while the lower class can buy essential goods without hesitation.

This reform is truly a people-friendly move that will reduce inflation and bring smiles to millions of households across India.

Good news