NEW GST Slab 2025: Items under New GST 2025

New GST Slab 2025 updated list

#GSTreform2025 #newgstitemlist

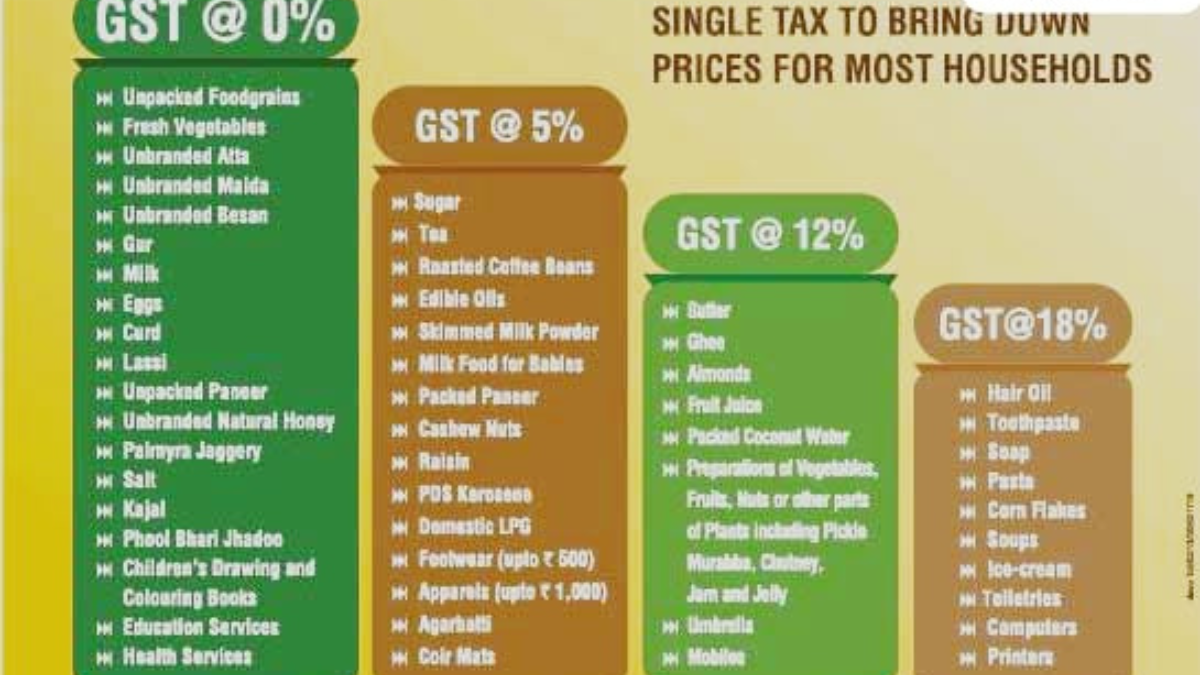

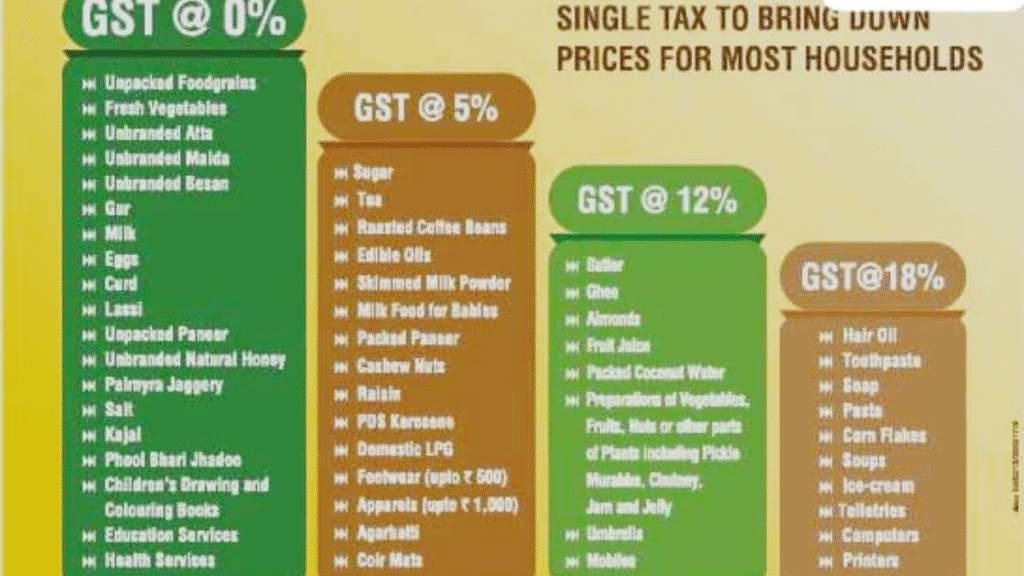

GST was launched in India in 2017 and since then it has become the biggest reform. Now in 2025 the government has brought the New GST Slab. The biggest change in GST 2.0 is that now there will be only 2 slabs.

Yes, earlier GST used to have 4 slabs but now only 2 slabs remain – 5% and 18%. This new tax has been applied to reduce GST rates so that goods and services become affordable for common people.

What is GST Slab?

Goods and Services Tax was launched in India by Modi on 1 July 2017. In the old GST, 4 slabs were applied – 5%, 12%, 18% and 28%.

For many people, in fact for common people, it became very expensive and complicated. Things started becoming costly. After many years of discussion, the government decided to make GST simple and affordable.

Government launched GST Reform 2025 for major reasons

- Because of too many slabs, there was a lot of confusion among customers and traders. To remove this confusion, the new GST was applied.

- If the government reduces GST on daily items and goods, the public will spend more on these things.

- Many countries used only 2–3 slabs, so GST 2.0 was also introduced to match that level.

So on 22 September 2025, the government launched GST 2.0.

Key Features in New GST Slab

- Now there will be only 2 slabs – 5% and 18%.

- On some items like food, milk, bread there will be 0% GST, meaning GST free, no tax.

- On luxury and sin goods like alcohol, cars, tobacco there will be 40% GST.

List of New GST Slab in India

- On wheat, rice, bread, paneer, curd, milk, roti, dal, fresh vegetables – no tax will be applied, meaning 0% GST.

- On packed food, medicine, rail tickets, bus tickets, basic household items – 5% GST will be applied.

- On electronics, mobiles, TVs, washing machines, fridge, ACs, small cars – 18% GST will be applied.

- On luxury cars, pan masala, tobacco, alcohol – 40% GST will be applied.

Items under 0% Slab

- Wheat, Rice, Pulses

- Milk, Paneer, Curd, Butter, Ghee

- Bread, Chapati, Roti, Paratha, Salt

- Fresh Fruits and Vegetables

- Books and notebooks

Items under 5% Slab

- Tea, Coffee

- Sugar, Jaggery

- Edible Oils

- Medicine, Life-saving Drugs

- Transport (Bus, Train)

- Small Packed Food

Items under 18% Slab

- Fridge, Washing Machine, A.Cs

- Phones, TVs, Laptops

- Cars (Small and Mid)

- Furniture, Mattresses

- Online Apps

- Hotel Rooms

Items under 40% Slab

- Luxury cars

- Soft Drinks

- Alcohol

- Pan Masala, Tobacco

- Resort

Good Impact of GST 2.0 on People

With this new GST, common people are very happy because now they can get things at affordable prices.

- Because of 0% tax on food items, people are very happy. Their kitchen expenses have reduced a lot.

- Electronics have also become very affordable, so now even common people can buy AC and TV.

- But on luxury items, tax has directly increased to 40%, which has made some people a little unhappy.

Impact on Business

- Along with customers, it has also become very relaxing for businessmen.

- Earlier, due to 4 slabs, shopkeepers had a lot of confusion, but now everything is clear.

- Because prices have reduced, their sales are increasing more.

Benefits of New GST Slab

- With the reduction of prices on items, people can now buy more goods.

- The more people spend, the more benefit it will bring to India’s economy.

- Shopkeepers will no longer have any confusion in GST.

- Transparency has come in taxation.

- Luxury spending will now reduce a little.

Criticism of New GST Slab

More than half of the people in India are happy with this GST slab, but there are also some who are criticizing it.

- People are not happy with 40% GST on certain items.

- State government’s revenue from alcohol and tobacco will remain low.

Conclusion

Overall, with this New GST Slab 2025, people living in India are very happy and they are praising this decision of the government.

Day by day inflation was increasing in India and it was becoming very difficult for common people to live. People had to think 10 times before buying one item.

But now the middle class and lower middle-class people can buy these things and enjoy all the facilities.

This decision of the government will also have a very good effect on India’s economy because the more affordable the items are, the more the public will spend, which is very good for the economy.

So, from today, you can also make your list and do shopping for your home items without hesitation and buy freely.